Simplifying Export Procedures under GST .Discover the significance of exports under GST and learn about the streamlined procedures involved in exporting goods. From obtaining a GST registration to filing shipping bills and claiming refunds, this blog provides valuable insights for first-time exporters.

Under GST, the term “Exports” refers to the supply of goods outside the territory of India. Therefore, it’s crucial to understand that for a transaction to meet the criteria of being an export, the physical movement of goods beyond the Indian borders is an indispensable element.

Are Supplies to Merchant Exporters Considered Exports?

According to Section 2(5) of the CGST Act, 2017, the supply of goods to merchant exporters cannot be treated as exports as the goods are not physically taken outside of India. This distinction is important to understand in the context of GST for export procedures.

Export Procedure under GST: A Step-by-Step Process

- Obtain a Valid GST Registration: All exporters, regardless of the value of goods being exported, must obtain a valid GST registration by registering with the GST portal. This registration is a prerequisite for exporting goods.

- File a Shipping Bill: To initiate the export process, the exporter must file a shipping bill with the customs authorities. This document contains essential details such as the goods being exported, the destination country, and the port of discharge. Accuracy and compliance with regulations are crucial at this stage.

- Declare Exports in GST Returns: Exporters must declare their exports in the GST returns by filing Table 6A of the GSTR-1 form. This involves providing information such as invoice numbers, the value of goods or services exported, and the destination country. This data is crucial for processing IGST refunds related to exports.

- Pay IGST and Claim Refund or File a Letter of Undertaking (LUT): Exporters must pay the IGST on exported goods and subsequently claim a refund by filing the GSTR-3B or RFD-01A forms. To support the refund application, it is essential to submit relevant documents such as the shipping bill and invoice. Alternatively, exporters can opt for filing a Letter of Undertaking (LUT) to facilitate zero-rated supply without charging GST on exports.

- Generate an E-way Bill: To comply with transportation regulations, exporters must generate an e-way bill for the consignment of goods being exported. This document includes details such as quantity, value, and destination. E-way bills can be generated through the GST portal or a mobile app.

Simplified Export Procedures through the GST Portal

The introduction of electronic export procedures has simplified the process for exporters. Through the GST portal, exporters can electronically file GSTR-1 forms, generate e-way bills, and claim GST refunds. This digital approach reduces time and effort, enhancing the overall efficiency of the export process.

Filing Table 6A of GSTR-1 on the GST Portal: Step-by-Step Procedure

- Log in to the GST portal and navigate to ‘Services,’ ‘Returns,’ ‘Return Dashboard,’ and ‘GSTR-1.’

- Select the relevant month for filing and click ‘SEARCH.’

- Click on ‘Table 6A FORM GSTR-1.’

- Begin filing the return by clicking the ‘ADD INVOICE’ button.

- Enter the required details for each invoice, including invoice date, port code, shipping bill number, shipping bill date, total invoice value, and GST payment (with or without IGST on exports).

- Save the entered invoices and complete other sections of GSTR-1 before submitting the return.

- Verify all invoices, click the ‘FILE RETURN’ button, and select the authorized signatory for filing the return using DSC or EVC.

Exports via Foreign Post Office by E-Commerce Operators

To facilitate e-commerce exports, all Importer-Exporter Code (IEC) holders must export goods through the Foreign Post Office. This enables zero-rating of exports through IGST refund or the discharge of a Letter of Undertaking. The “Exports by Post Regulations, 2018” provide the necessary declaration forms for e-commerce exports through the post.

Streamline Your Export Journey with GST

Understanding the significance of exports under GST and following the prescribed procedures is crucial for first-time exporters. By leveraging the benefits of GST registration, accurate documentation, and electronic filing, exporters can streamline their operations and navigate the export landscape with ease.

What are the top 20 Export Companies in India?

- Tata Group

- Reliance Industries Limited

- Adani Group

- Essar Group

- Vedanta Resources

- Mahindra Group

- Bharti Enterprises

- Wipro Limited

- Infosys Limited

- HCL Technologies Limited

- TCS Limited

- Dr. Reddy’s Laboratories

- Sun Pharmaceutical Industries Limited

- Cipla Limited

- Lupin Limited

- Glenmark Pharmaceuticals Limited

- Divi’s Laboratories Limited

- Hindustan Unilever Limited

- Nestle India Limited

- Maruti Suzuki India Limited

What is Rate of IGST charged on goods?

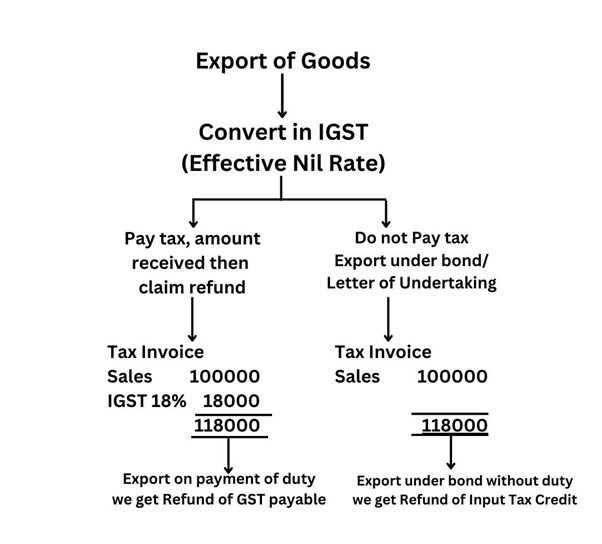

IGST can be paid in two ways because Exporter has two options:

- Pay IGST on full rate applicable on item and claim refund after receiving money from abroad.

- Do not pay IGST and Exports Goods under Letter of undertaking.

How Exporters can claim Refund under GST?

Exporters can claim a refund of GST paid on the goods or services exported and inputs used in manufacturing such exported goods in case he does not have any domestic sale from which he can adjust such inputs. The procedure for claiming GST refunds for exports involves the following steps:

- File the GSTR-1 form: The exporter must file the GSTR-1 form to declare the exports made during the tax period. This form should contain details such as the invoice number, the value of goods or services exported, and the destination country.

- File the GSTR-3B form: The exporter must file the GSTR-3B form to pay the tax on the exports made during the tax period. The IGST paid on the exports will be available as an input tax credit for the exporter.

- File the shipping bill: The exporter must file the shipping bill with the customs authorities. This document contains details such as the goods’ description, value, and destination country.

- File the refund application: The exporter must file the refund application in Form RFD-01 within two years from the relevant date. The relevant date is when the customs authorities filed the shipping bill. The refund application should contain details such as the invoice number, the shipping bill number, and the refund amount claimed.

- Submit the required documents: The exporter must submit the documents and the refund application. These documents may include a copy of the shipping bill, the invoice, and the GSTR-3B form.

- Processing of refund: The refund application will be processed by the GST authorities within sixty days from the date of receipt. The exporter will be notified if any discrepancies are found, and the refund may be delayed.

What is the Compliance under GST for Exporters?

Exporters is required to comply with certain GST regulations to ensure that they meet their tax obligations and avoid penalties for non-compliance. Some compliance requirements for exporters under GST are:

- Filing of GST returns: Exporters must file their GST returns on time. The GSTR-1 form must be filed to declare the exports made during the tax period, and the GSTR-3B form must be filed to pay the tax on the exports made during the tax period. If returns are not filed on time can result in penalties and interest charges.

- Maintenance of proper records: Exporters must maintain proper records of their exports, including the invoice number, the value of goods or services exported, and the destination country. This will help them in filing their GST returns and claim refunds.

- Compliance with export procedures: Exporters must comply with the export procedures laid down by the customs authorities, such as filing the shipping bill and obtaining the necessary export licenses. Please comply with these procedures to avoid penalties and delays in the export process.

- Reconciliation of data: Exporters must reconcile the data in their GST returns with the data in their shipping bills and other export-related documents. This will help them identify discrepancies and take corrective action to avoid penalties.

Penalties for non-compliance can range from a monetary penalty to cancellation of GST registration. Exporters can take the following steps to ensure that they meet their compliance obligations:

- Regular monitoring: Exporters must regularly monitor their compliance with GST regulations, including filing returns and maintaining records.

- Training and awareness: Exporters must train their employees on GST regulations and ensure they know their compliance obligations.

- Use of technology: Exporters can use technology such as GST compliance software to ensure that they meet their compliance obligations and avoid errors in their GST returns.

In conclusion, exporters must ensure compliance with GST regulations to avoid penalties and delays in their export process. This requires regular monitoring, training, and the use of technology to meet their compliance obligations.

What are the compulsory Details to be mentioned in case of Export Invoice?

Details mentioned in Invoice:

- Name and Address of the buyer

- Delivery address mentioned in Invoice

- Destination of country

- Number and date of application for removal of goods for export

Whether any records are required to be maintained by Registered person for sending specified goods outside India?

The Registered person dealing in specified goods shall maintain a proper record of such goods.

When the specified goods send out of India is considered as a supply?

- The specified goods are sent out of India are required to be either sold or brought back within the period of six months from the date of removal as per the provision contained in sub-section (7) of section 31 of the CGST Act.

- The supply would be deemed to have taken place on the expiry of six months from the date of removal, but if the specified goods are neither sold abroad or not brought back within the period.

- If the specified goods are sold abroad fully or partially within the period of six month the supply is affected, in respect of quantity sold on the date of such sale.

Whether invoice is required to be issued when the specified goods sent out of India are not brought back, either fully or partially within period?

When the specified goods sent out of India have been sold fully or partially within period of six months. The sender is liable to issue a tax invoice in respect of such quantity of goods which has been sold.

But when the specified goods sent out of India have neither been sold or not brought back either fully or partially within the period of six months, the sender shall issue a tax invoice on the date of expiry of six months from the date of removal, or in respect of such quantity of goods which are not sold.

Illustration: M/s PQR send 100 units of specified goods out of India. The activity of sending out such specified goods out of India is not a supply. No tax invoice is required to be issued in this case but the specified goods shall be accompanied with a delivery challan issued in accordance with the provision contain in rule 55 of CGST.

Let’s assume If 10 units ofspecified goods are sold abroad say after one month of sending goods and another 50 units are sold after two months of sending goods, a tax invoice would be required to be issued for 10 units and 50 units.

If the remaining 40 units are not brought back within the period of six months from the date of removal, a tax invoice would be required to be issue for 40 units in accordance to section 12 and section 31 of CGST Act.

Further, M/s PQR may claim refund of accumulated Input tax credit (ITC) in accordance with provision of sub section (3) of section 54 of CGST Act.

GET IN TOUCH